Fintech flexible payroll solutions driving productivity and enhancing financial wellness in the workplace

Cost of living pressures and rising inflation around the globe combined with falling real wages is affecting many Australians – making workers feel more financially stressed than ever before. In response, many Australian consumers and workers are topping up their incomes by using buy-now-pay-later (BNPL) credit platforms – in some cases, financially over-extending themselves with debt they are unable to service. RFI Global Research found that there were over 5.9 million active accounts for buy-now-pay-later platforms (such as Zip and Afterpay). This figure increased significantly from March 2021 to March 2022 with adoption rates increasing from 32% to 38% over this period.

In this economic climate, there’s ways that HR departments can help their staff feel more in control of their financial well-being – starting with education and offering employees more flexible and easier access to their hard-earned wages using more responsible alternatives to BNPL credit platforms. Employees who feel more secure and confident about their financial situation are more likely to report being happy in the workplace. This can also translate into better retention rates of staff over the longer term – which is important for companies struggling to find and retain good staff in today’s tight labour markets.

Learn more: Compensation tips to attract, retain talent amid tough labour market

Morgan Stanley at Work considered the impact of financial stresses on employees (in the United States) and concluded that the solution lies in teaching staff about financial empowerment and giving them choices about when they can access their earned wages.

Data from Morgan Stanley at Work on financial empowerment

HR departments and managers can also help – starting with educating their staff about financial empowerment and providing useful strategies and guidance to help them take control of their own financial wellbeing. These strategies can include HR offering staff immediate access to their earned salaries in a way which is responsible and deters them from seeking out financial alternatives (which don’t require the usual credit checks) such as buy-now-pay-later (BNPL) schemes which have become increasingly popular around the globe.

Over the 2020-21 financial year alone, Australians reported spending almost $12 billion on popular buy-now-pay later platforms such as Afterpay and Zip just to meet their day-to-day living expenses.

In June 2022, RFI Global (for the Australian Finance Industry Association) released their a report titled “The Economic Impact of Buy Now Pay Later”. That report found that in Australia there were approximately 5.9 million active BNPL accounts for the period 1 July 2021 to 30 September 2021 – for people aged between 18 and 89 years. The report did note however that this figure (5.9 million) could include customers who have more than one account with a buy-now-pay-later provider.

These BNPL credit platforms allow consumers access to cash without the usual rigorous credit checks which apply for bank loans and other types of lending services. Consumers simply borrow the money and agree to pay it back later in agreed instalments. The problem is, some borrowers over-extend themselves and all of a sudden they are in significant financial distress – which adds to their stress in the workplace.

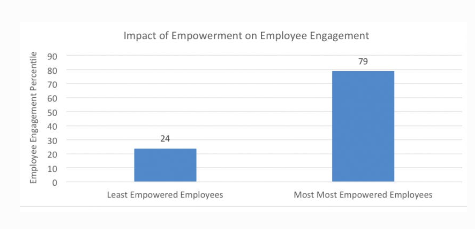

In a Forbes study of 7,000 employees surveyed which measured financial empowerment with employee engagement, found that employees with a low level of financial empowerment were likely to be less engaged in the workplace.

Forbes study measured financial empowerment against employee engagement

So, firms with staff with higher levels of financial empowerment are more likely to be engaged and on task in the workplace. Companies who seek to enhance their staff’s financial wellness and security will reap the benefits with better productivity and performance in the longer term. This is where HR departments can consider business-to-business payroll solutions which offer their staff more control over their finances. Such solutions can provide genuine financial empowerment in the workplace.

Learn more: Free Whitepaper: Reimagining Payroll with SAP

One of the newest players on the business (B2B) fintech solutions scene in Australia is CashD which offers businesses greater flexibility in the way they manage their staff’s pay cycles. It also creates some degree of financial empowerment for employees wanting earlier access to their earned wages. CashD is a strictly B2B model which combines “banking, payroll and finance” so as to “better address the needs of today’s workforce.” It works directly with employers to help staff access their income in a more flexible manner.

HRD Australia spoke with CEO and Founder of CashD, Marcus Lasarow to find out more about their services and how HR teams can use these to financially empower their staff.

Founder and CEO of CashD spoke to HRD Australia about solutions

Founder and CEO of CashD spoke to HRD Australia about solutions

HRD started by asking what immediate steps HR managers can do to help staff members struggling with cost-of-living pressures? Lasarow explained that businesses using CashD can help their staff access their wages earlier than the usual fortnightly or monthly pay cycle. So, instead of a worker having to wait for the end of a pay fortnight, or month, they can simply request their employer (using the CashD dashboard) to release an agreed portion of their salary a bit earlier to help with cost-of-living pressures.

HRD asked Lasarow what inspired him to create CashD in the first place – and what was the lightbulb moment that made him think that this business model could really help employers? Lasarow provided some background by telling HRD that: “There's always been personal loans. There's always been cash advances on credit cards, but in the last two years, the rise of buy-now-pay later and these direct-to-consumer models are hurting employees or workers around the world, not just Australia.”

Lasarow explained that he founded CashD to be able to offer more agile financial solutions for employers seeking to give their staff more flexibility around the delivery of their earned wages. Lasarow intended that CashD would be offering a more responsible alternative to other sources of credit in the marketplace.

Some of the key benefits of platforms like CashD include:

HRD asked Lasarow to explain what was the biggest challenge for CashD in terms of demonstrating their point of difference to customers? Lasarow said: “Our biggest challenge is to educate employers on the fundamental difference between what CashD offers comparative to payday loans, credit advances or any personal loan connected to a high interest-bearing intrusive product.” The business model of CashD was designed to help businesses offer their employees these services as a responsible alternative to buy-now-pay-later credit services.

Lasarow told HRD how their product had built-in mechanisms to protect both the employer and the employee. Marcus Lasarow explained that the biggest benefit of B2B solutions like CashD for HR departments was that it puts the prospective new employee or existing employee firmly in the driver’s seat by asking them “How would you like to get paid?”

Because CashD seamlessly “integrates into a company’s payroll, HR and workforce management solution” – it gives both HR payroll teams and the employee flexibility around the timing and method of salary payment. Lasarow explained how his product works in a practical sense: “We empower the employer to invite the employee to use CashD” which has a two-click mechanism system where staff and businesses can access an accrued wallet – which builds up over time in line with hours worked. Payments are also reconciled in real time and there are other privacy protections built-in for the employee. CashD only uses know your customer (KYC) for the employer, not the employee. So, the employee’s banking details are only known by the employer and never at risk of being disclosed to third parties.

CashD is simply a vehicle for employers to provide easier access by their staff to their earned paycheques. So CashD, being a B2B service deals directly with employers and HR departments and not the employees. CashD also has built-in regulatory frameworks such as anti-money laundering (AML) and counter-terrorism financing (CTF) policies and transactions are regulated and monitored by Austrac in accordance with recommended Australian Government guidelines.

At the end of the day, B2B services like CashD can help reduce financial stress in the workplace by providing easier access to employees to their earned income. Less stress in the workplace “obviously equals higher productivity. And lastly, simply happier workers. These are some of the employer benefits” Lasarow told HRD.

He also insisted that CashD’s business model really wants to be informing HR thought leaders about solutions, first and foremost, even before CEOs. This is because HR departments are on the frontline of managing employees’ general well-being – and financial empowerment around delivery of wages goes a long way in this regard.