Employee recognition and appreciation can help reinforce desired behaviours, which in turn can help shape corporate cultures – but what happens when the wrong behaviours are being recognised?

Employee recognition and appreciation can help reinforce desired behaviours, which in turn can help shape corporate cultures – but what happens when the wrong behaviours are being recognised?

Over the past three months the damning headlines spawned by the findings of the banking royal commission have been hard to ignore. The royal commission was established in late December 2017 following years of public pressure from whistleblowers, consumer groups, and various political parties. Its first public hearings began on 13 March, and they will run at irregular intervals through 2018.

The royal commission has been asked to investigate whether any of Australia’s financial services entities have engaged in misconduct, and if criminal or other legal proceedings should be referred to the Commonwealth.

For critics of big business it’s been a boon, confirming their worst suspicions and presenting myriad examples of misconduct. It has also cast a pall over how the public perceives these organisations – and specifically the types of workplace culture that allow such behaviour to go unchecked. AMP is the most recent to come under fi re, and it may not be the last.

Recognition’s role in shaping culture

Although there are many elements that constitute a ‘culture’, it is ultimately shaped by the people who work in an organisation and the behaviours they display. How certain behaviours are recognised and encouraged can therefore have a significant impact on culture.

Alan Heyward, managing director at O.C. Tanner | Accumulate, says recognition on its own is not the be all and end all, but it’s certainly a key influencer of culture.

“The O.C. Tanner Institute undertook global research which showed that recognition is one of if not the most important lever organisations can pull to positively impact most aspects of workplace culture,” Heyward says.

He adds that recognition and appreciation are closely interlinked with how employees connect with a company’s purpose, how they share ideas and innovate, how they view opportunities within the business to grow their careers, how much they feel valued, and how they feel about their leaders.

Sales vs service cultures

With that link between recognition and culture established, Heyward says it’s critical to differentiate between a ‘sales’ culture and a ‘service’ culture, especially as it’s evident that too many of the organisations targeted by the royal commission have focused heavily on creating the former via monetary incentives. This focus has contributed to the intense scrutiny they now find themselves under.

“We’ve seen a growing trend around organisations structuring recognition programs in a way that more closely aligns with positive customer outcomes, or behaviours that are consistent with company values rather than widget-based, metric-based rewards,” Heyward says.

He adds that any organisation that has a sales culture may be at risk of the wrong behaviours being rewarded – or indeed not having behaviour-based metrics of any kind factored into assessments of performance.

“This is not unique to banking. There are organisations in other sectors that have really focused on a sales culture, and they are at risk, like the banks, of getting torn apart at some point if they don’t start thinking about driving the right behaviours as opposed to the right outcomes.

“You get the result of what you incentivise; how you get there doesn’t matter unless you build that criteria in. We’ve seen plenty of examples, recently and over the last three or four years, that are directly related to people being incentivised for an outcome that didn’t take into account how they got there,” Heyward says.

This is not to say financial incentives or rewards for outcomes should not be used, and Heyward says the link between reward and recognition remains strong.

“There should be no reason why you can’t incentivise people for outcomes,” he says. “The problem has been the focus on the outcome without the focus on how you got there. Reward and recognition are separate, but they are also so closely related that recognition can be much more powerful and can be embedded a lot more deeply when there is a reward element.”

Heyward says many organisations could benefit from implementing behavioural elements into their bonus and commission structures.

“Banks have been doing that for a while with balanced scorecards and so on, but the question is whether they have the right behavioural metrics in there or are they just using a different set of outcome metrics that don’t have enough rigour behind them to ensure the right outcomes? In particular, are they acting in the best interest of the customer, which everyone is focused on right now?”

Of course, talking about a culture change is one thing; taking action is another matter. Heyward notes that culture is made up of all the people within an organisation at a point in time, so it’s a constantly evolving entity. It’s therefore not possible to simply announce, “We’re changing our culture”.

“You’ve got to get the masses on board for the change you’re making,” he says. There has been plenty of evidence to suggest that small changes won’t be enough to change an overall culture.

The point that may get a little lost in the current storm surrounding the royal commission is that some banks have already taken steps to change the incentive focus within specific departments – and while that has been laudable, inconsistencies have remained in terms of how people are incentivised across the organisation, making it very difficult to effect across-the-board culture change.

A mindset shift

O.C. Tanner | Accumulate is advising its banking clients and prospects on three key areas in which to build service cultures. Heyward explains:

Capability. This is not just about product knowledge but having ethical customer principles and practices; it’s encouraging people to educate themselves to do the right thing. This involves having a framework in place so that the bankers, tellers, advisers better understand their products and services, but also having accredited L&D programs so people can build from one level of product knowledge to the next. It means you’re not incentivising the sale; you’re incentivising people to become equipped to do the right thing.”

Behaviour. “It’s possible to observe in that same group of workers whether people are behaving consistently with the values of the customer. Very few people are working autonomously with no observation, particularly in the banking sector. There are other people – peers, managers, subordinates – who can observe what’s happening and check to see if the right behaviours are being displayed.”

Customer experience. “This comes down to how you capture and recognise customer outcomes through NPS and other customer satisfaction metrics. These organisations might benefit from building more robust customer satisfaction collection frameworks to get deeper insight into how individuals are performing as opposed to how a branch is performing.”

HR’s role

HR has a major role to play in culture change; however, Heyward hastens to add that it’s not HR’s role to shape culture or drive culture change.

“They are a contributor to culture and almost like a custodian of it. HR would almost be better to say, ‘We’re looking after this box called culture; we’re not dictating what needs to go into it but we are a contributor to it, along with many other stakeholders’.”

Heyward also disagrees with the commonly heard criticism of HR being too far removed from customers to have much impact on a service culture.

“HR business partners are much closer to the frontline where things are happening,” he says. “All executives have a hands-on role to play in shaping the culture and ensuring the culture is about driving the right behaviours as opposed to financial outcomes and results. But if you only have HR pushing behaviour, and if no one else buys into that, guess what’s going to happen? The ownership of culture sits across the whole business.”

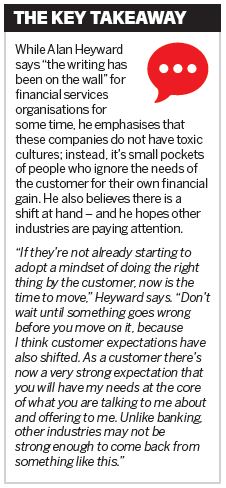

However, HR can also reinforce desired behaviours and values throughout the recruitment process by encouraging leaders to role-model those values and behaviours (and to do so themselves) – and by recognising and appreciating all employees who go above and beyond. Only then will service come before sales.