In 2014, Australian companies will be watching new European caps on bonus payments in the financial sector with interest, Stephen Burke reports

What led us to the GFC? Was it executives engaging in unsustainable, unreasonable risk-taking in exchange for super-sized bonuses? While the good times rolled, they were coming out way on top, but other times they were losing money hand over fist. Australia acted to curb this reckless behaviour in 2009, but Europe’s financial sector is about to take things a step further.

New standards on bank capital came into force in the European Union as of 1 January 2014. Capital Requirements Directive IV (CRD IV) has been designed to strengthen the capacity of EU banks to more effectively manage the risks linked to their activities and absorb any losses they may incur in doing business. Australian companies with EU ‘parents’ are likely to feel these changes most acutely but there are likely to be fl ow-on effects for the broader Australian finance sector.

MATERIAL RISK-TAKERS

Essentially, CRD IV caps bonuses of senior staff in the finance industry considered “material risktakers”, particularly in asset management and investment banking, at 100% of fixed pay (or up to 200% of fi xed pay if approved by shareholders). It applies to any staff deemed to have a role that takes on material risk of:

- EU-headquartered fi rms, for example large banks, and will include those in senior roles in markets outside the EU, including Australia

- firms located in the EU, including subsidiaries of non-EU organisations, so material risktakers of foreign-parented firms located in the EU will also be caught

So, what constitutes a ‘material risk-taker’? Any person in the above two types of organisations with total remuneration greater than ¤500,000, or whose pay otherwise places them among the highest paid 0.3% of staff or at the same level as the lowest paid senior management of the firm.

While the Australian Prudential Regulatory Authority (APRA) has given no sign that it is looking at similar regulation, the response of EUparented (and other affected) organisations located in Australia is likely to impact the market here. APRA instituted a number of changes to regulation of pay-related risk through prudential standards issued in 2009.

REVISED PAY MODELS

EU-parented companies are considering alternative pay models for affected staff to comply with CRD IV. The primary change contemplated is to increase fixed pay to broadly maintain current levels. This would be introduced as a ‘role allowance’ and, as a result, would not be pensionable or fl ow through to other benefits.

Organisations are also talking about extending their long-term incentive vesting to take advantage of a ‘discount’ available for vesting periods equal to or greater than five years. This could be achieved by attaching an additional deferral period to the end of market-practice three-year vesting/performance periods.

CURRENT FINANCE SECTOR PAY MODELS

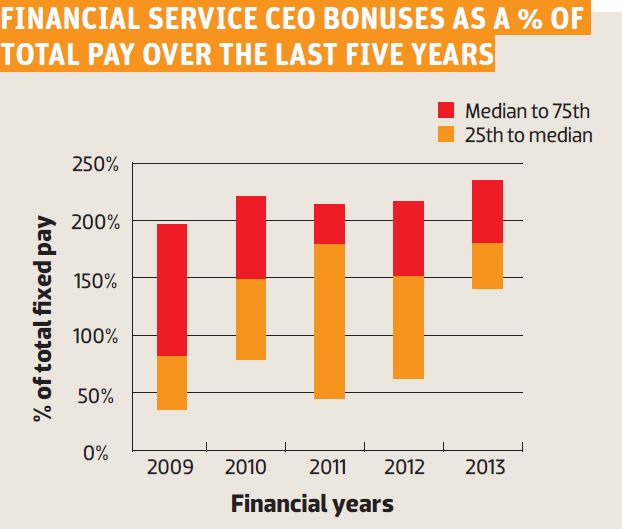

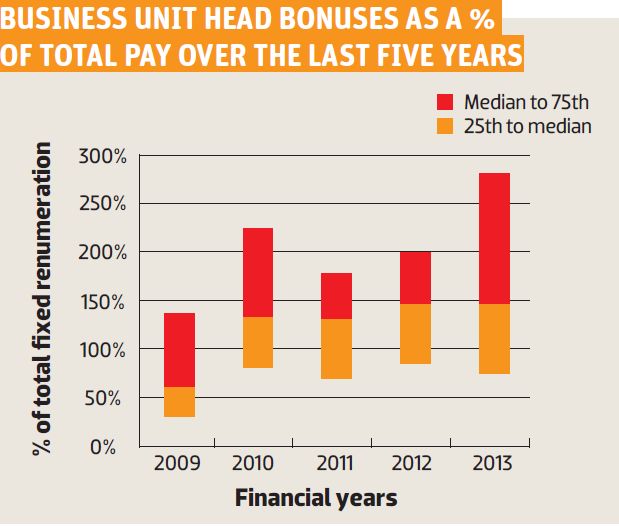

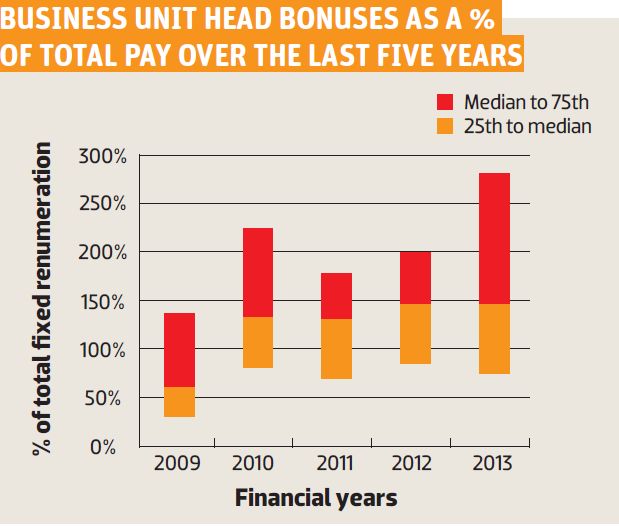

Bonus payments as a percentage of fixed pay have trended downwards in recent years, driven by changes in the underlying economics of financial services (namely, a fall in profits) rather than modifications to pay models. However, variable pay in financial services (outside retail banking) and particularly in investment banking and investment management is, typically, several times fixed pay in years of good performance. Before the GFC, there were examples of senior executives receiving 30 to 40 times fixed pay in bonuses. In financial year 2013, there were still examples of senior executives receiving variable pay of up to 10 times fixed pay as some organisations began to feel profit recoveries.

The charts below illustrate that among selected ASX-listed companies in the financial services sector, which tend to have more conservative practices than foreign-parented and privately owned competitors, variable pay at median routinely exceeds the 100% cap imposed by CRD IV and, at the upper quartile, frequently exceeds the 200% cap available with shareholder approval.

The investment pay model led to a very healthy bonus structure during strong performance periods but it also has drawbacks for participants. Weak profit performance means a decline in total pay as bonuses are cut, and the industry is often quick to reduce headcount in the face of downturns. At the end of the day, this is a high opportunity/high risk model.

(click on image to enlarge)

(click on image to enlarge)

CRD IV AND AUSTRALIAN COMPANIES

The extent to which Australian companies (with EU parents) are affected will depend on how far down the organisation the CRD IV rules are deemed to apply. In general, we expect fixed costs will increase, there will be a lower correlation between overall remuneration spend and performance, and the ability to reap large cost savings from bonus reductions will be significantly reduced; that is, the business will lose flexibility.

If this proves to be accurate, in good times total pay will remain broadly competitive with the market (and we can be sure organisations will undertake a great deal of work to remain competitive) but in the face of a business downturn EU-parented firms may be forced to cut jobs faster than they have in the past to maintain profitability.

More broadly in Australia, the effects of these changes are likely to be influenced by an executive’s unique risk appetite and view of the economy. Executives with a high risk appetite and/or a positive view of the economy, financial services industry and their ability to earn high profits may be more inclined to remain with organisations offering the current pay model. Risk-averse executives, on the other hand, might be drawn to EU-parented firms for their offer of higher fixed pay in uncertain times. The quandary for this latter group, however, is the possibility of a lower level of job security.

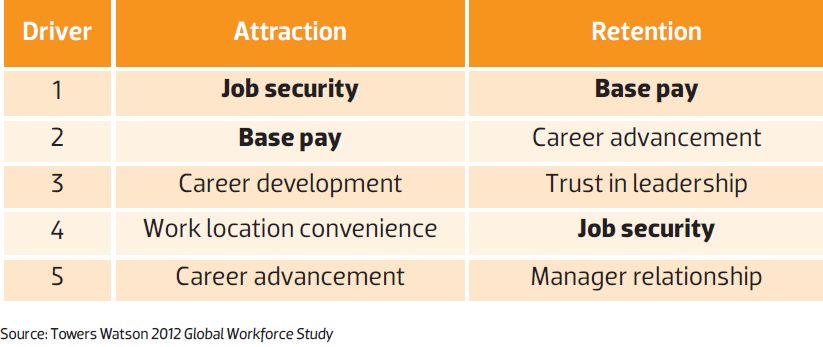

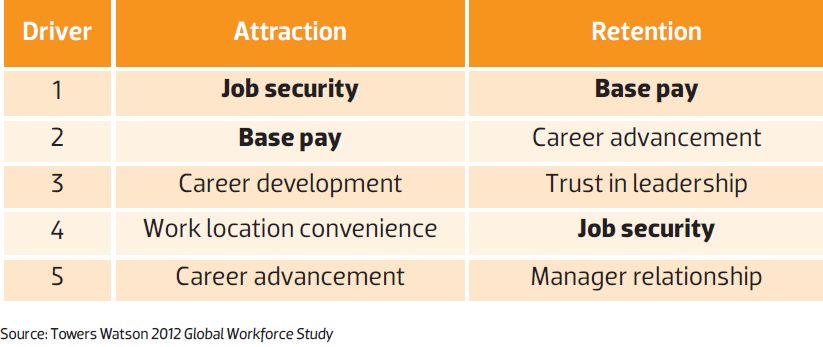

Findings from Towers Watson’s 2012 Global Workforce Study show that job security is the number one concern among Australians seeking a new job, and base pay is the key retention driver. While a higher level of risk tolerance is likely in the finance sector, we would still expect a movement towards the same priorities as the wider workforce. This means attracting and retaining talent could be a real balancing act for EU-parented firms.

(click on image to enlarge)

Stephen Burke is director, executive compensation, Towers Watson

Stephen Burke is director, executive compensation, Towers Watson

Stephen Burke is director, executive compensation, Towers Watson

Stephen Burke is director, executive compensation, Towers Watson