Recent cases have shown that the courts are prepared to come down hard on sham contracting. In this article, Mark Diserio, Kaitlyn Gulle and Kate Oaten from Lander & Rogers, take sham contracting back to basics.

Sham contracting - what is it and why should I care?

Sham contracting is used to describe the deliberate mischaracterisation of an employment relationship (i.e. a relationship between an employer and an employee) as a contractor relationship (i.e. between a principal and independent contractor).

The issue for HR professionals is that the worker, who may be receiving a higher hourly rate as a contractor, is not receiving all the entitlements (e.g. annual leave, sick leave, public holidays, superannuation) and job security which they would be entitled to receive if they were an employee of the company.

Representing that someone is an independent contractor when they are really an employee, or firing an employee and re-engaging them as an independent contractor to do the same work they did previously, is unlawful - and it is not just the corporate entity or employer who may be in trouble. A person, such as an HR representative or manager, who was involved in the sham contract or has "turned a blind eye", may also face serious penalties.

Overview of sham contracting provisions in the Fair Work Act 2009 (Cth)

The Fair Work Act seeks to protect genuine employees from sham contracting arrangements by making it unlawful for a person, or a company, to:

- misrepresent that a contract of employment is an independent contractor agreement, or tell a genuine employee that they are an independent contractor;

- dismiss (or threaten to dismiss) a genuine employee in order to then engage them as an independent contractor; and

- make a false statement to persuade or influence, or mislead a genuine employee, to enter into a contractor arrangement to perform the same (or similar) work they performed previously.

In December 2015, the High Court of Australia confirmed that the sham contracting provisions extend to "triangular" arrangements, where employees are ostensibly engaged as independent contractors through a third party, such as a labour hire provider. This particular case clarifies that the prohibition on employers from misrepresenting to an employee that they work as an independent contractor under a contract also applies to an arrangement with a third party. This means that employers cannot rely on third party arrangements to avoid liability for misleading representations about the true nature of contracts with their employees.

How do I know if a worker is an employee or an independent contractor?

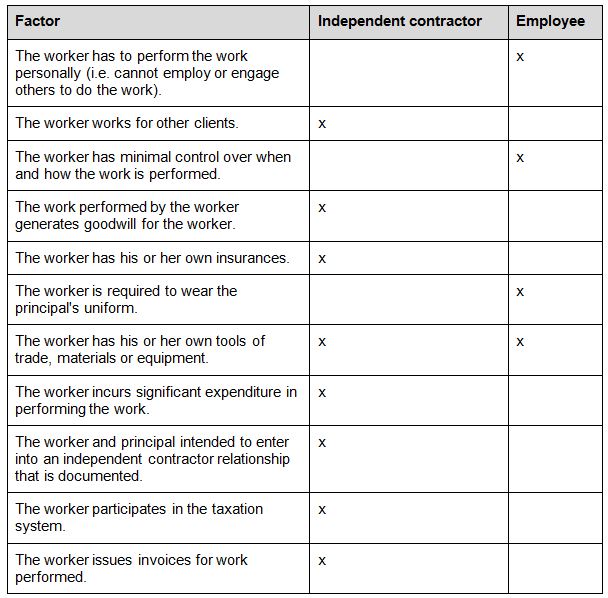

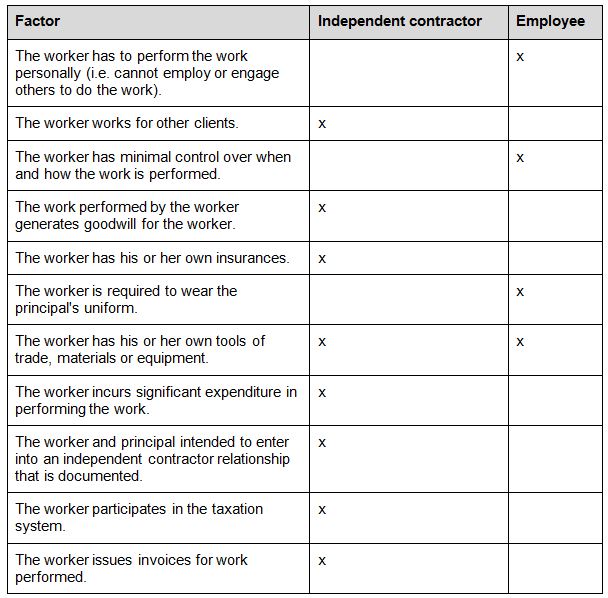

Unfortunately for HR professionals, there is no one single factor that determines whether a worker is an independent contractor or an employee. However, there are a number of factors that are generally considered when making the assessment. The below table sets out some of these key factors and whether they are suggestive of an employment or contractor relationship.

No one factor, of itself, will be determinative and some factors are capable of pointing towards both an independent contractor or an employment relationship depending on the particular circumstances - for example, a worker who uses their own mobile phone is unlikely to be considered an independent contractor because of this factor.

In a useful reminder that it is the true nature of the working relationship that matters, rather than the description that the parties give it, the December High Court decision specifically referred to the well-known statement that parties

"cannot create something which has every feature of a rooster, but call it a duck and insist that everybody else recognise it as a duck".

Imagine that Company A runs a flower delivery company and has a written contract with Sam under which she delivers flowers to clients by bicycle. Sam uses her own bicycle for the deliveries, but has to wear Company A's uniform. Sam is free to pick and choose when she works, but Company A tells her when and where to deliver the flowers. Sam, who is very friendly, generates a lot of goodwill for Company A's business. Company A pays Sam $15 per hour plus GST upon receiving an invoice from Sam for the deliveries she has performed that week.

Looking at Company A's relationship with Sam by reference to the above table, it is clear that Sam is actually an employee of Company A, not an independent contractor. If this relationship was not identified correctly, Company A could be contravening the sham contracting provisions of the Act and exposed to liability for back-payment of wages, leave entitlements, superannuation, payroll tax and income tax deductions.

Accessorial liability - getting personal

It is not only the organisation that needs to be concerned - HR professionals and managers can also be found personally liable where they are involved in breaches of the sham contracting provisions of the Fair Work Act.

Imagine you are the HR manager for Company A, and receive instructions from the CEO to prepare a written contract for Sam to "get around the employment laws" which expressly confirms that Sam is an independent contractor and not an employee. Your involvement in Sam's contract could expose you to liability for contravening the sham contracting provisions of the Fair Work Act and to civil penalties of $10,800 per contravention.

Bottom line for businesses and principals

- Make sure that the relationships you have with your workers are what you assume them to be - thinking that a relationship is with an independent contractor, when the worker is in fact an employee, can have serious consequences down the track. If in doubt, get advice.

- Business and principals must take care to ensure that misrepresentations are not made as to the true nature of a worker's engagement, or risk exposure to prosecution and pecuniary penalties for breaches of the Fair Work Act.

- It is critical to undertake a comprehensive analysis and to implement risk-management processes when engaging workers through non-traditional arrangements, such as contracting and labour hire firms. Businesses can still be liable for back-payment of entitlements and other liabilities if an employment relationship is later found to exist in law.

- Merely engaging workers through a labour hire arrangement is no guarantee that it is a genuine independent contractor arrangement. The recent High Court decision indicates that this will not necessarily be sufficient to avoid the sham contracting provisions in the Fair Work Act.

Mark Diserio is a Partner, Kaitlyn Gulle is a Senior Associate and Kate Oaten is a Lawyer in Lander & Rogers Workplace Relations & Safety practice. Mark can be contacted at

[email protected]