In the wake of the banking royal commission, organisations must rethink their approach to employee recognition. Alan Heyward, managing director of O.C. Tanner | accumulate, elaborates

.jpg)

“Providing a service to customers was relegated to second place. Sales became all-important.”

The words of Commissioner Kenneth Hayne in handing down the 76 proposed reforms contained within the banking royal commission report on 4 February formalised what we have all known for some time: widespread cultural transformation across the financial services sector is urgently required to rebuild public trust.

Where once a sales culture prevailed across the sector, in which financial targets were prioritised above, apparently, all else, financial institutions are now being compelled to undertake transformational change to create a sustainable, service-based culture in which the primary focus is, unquestionably, on the needs of the customer.

While it is the leaders of these financial institutions that will ‘direct’ this change and expect their employees to align and connect with a new organisational purpose, it is the belief, commitment and effort of those many thousands of frontline employees and managers that will dictate the success, or otherwise, of the transformation.

It is here that employee recognition has a critical role to play.

The power of appreciation

The evidence is clear – people who feel appreciated at work are happier, more engaged and add greater value than those who don’t have that same sense that what they do matters. The O.C. Tanner Institute’s 2018 Global Culture Report vividly illustrates the power of effective recognition in the workplace, generating among employees a 16% higher sense of personal wellbeing, 24% higher sense of opportunity within the organisation, a 23% higher sense of the quality of leadership, and a 20% increase in their connection to purpose.

The latter point must be uppermost in the minds of decision-makers, particularly when we consider that respondents to the global culture survey also indicated they were 121% more motivated to do their best work when recognition was tied to their organisation’s purpose, and only 20% of millennial employees planned to stay for more than five years in companies where they felt profit came before purpose.

Nor can the bottom-line benefits be ignored, as the Global Culture Report reveals that purpose-driven companies outperform their peers in share price by 12 times.

As financial institutions strive to transform, the ability to create an environment in which employees know their day-to-day efforts are both noticed and valued, and engagement, motivation and discretionary effort can thrive, will surely be one of the foundations on which their new purpose and culture are built.

The challenge, and conversely the opportunity, for financial institutions – and indeed all companies – is that Australia lags behind other key markets when it comes to employee perceptions of meaningful workplace recognition. Australia ranked 54% on the O.C. Tanner Institute’s Global Appreciation Scale (alongside the likes of the US, Canada, Japan, Germany) but was slightly behind the UK (57%) and significantly behind India (68%) and China (67%).

So, the banking royal commission report and the O.C. Tanner Institute’s 2018 Global Culture Report are aligned on the direction in which financial institutions must head if they are to effect culture change on the scale that is needed.

Employee recognition must be at the centre of the conversation. However, that conversation has changed significantly in recent times, and for it to have the desired cultural impact, it’s important to examine how.

A more holistic, sophisticated way

The people focus of organisations over the past few years has become far more holistic and sophisticated, with an organisational lens and data-driven decision-making becoming the norm, rather than the exception.

Where once there was a focus on ‘driving engagement’ and reinforcing behaviours that aligned with company values, the conversation has turned – sharply and importantly – to building a strong culture by considering the overall employee experience and how it aligns with organisational purpose and the customer experience. I’ve heard more than one HR executive within the financial services sector talk of their desire to create a “consumer-grade employee experience”.

The conversation is essentially now about companies finding ways of connecting employees – with each other, with their accomplishments and roles, and with the company purpose – in an increasingly disconnected world fuelled by a flood of new technology and continually changing workforce dynamics.

Fewer companies are relying on annual engagement surveys as a reliable organisational health check, in favour of more relevant and frequent cultural assessments, pulse surveys, and effective one-on-one conversations between leaders and their direct reports. The result is a far closer alignment of objectives and expectations with purpose.

This holistic focus also means that the days of employee recognition being a standalone HR initiative are becoming fewer; for leading companies, recognition is now a strategic organisational imperative with a measurable bottom-line return.

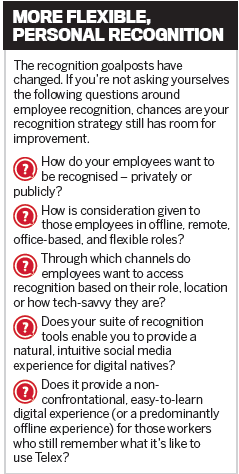

More flexibility, more personalisation, stronger connection

Many companies continue to scan the market for a recognition platform primarily aimed at a tech-savvy user base, but what are they really paying for? If it is purely a technology buy, the return is likely to be limited.

It is those companies that are considering the needs of all demographics – making recognition as relevant and personally meaningful as possible for each employee – that are making the most significant cultural inroads.

Not so long ago, social media channels were flooded with recognition content related to the rise and rise of the “entitled, impatient, idealistic” millennial generation and their expectations around frequent recognition and opportunity. Millennials are the dominant workforce segment, so their needs are arguably more important now than when the initial hysteria surrounding their emergence occurred. However, that conversation has also turned sharply – the rise of Generation Z, the first generation of true digital natives with relatively underdeveloped interpersonal skills, is high on the agenda. And let’s not forget about the needs of us Gen Xers and baby boomers.

Building leadership capability as it relates to recognition and appreciation has also grown in importance. Specific capability is now less a ‘nice to have’ and more a core competency that is integral to the role of every leader in driving culture change.

Put simply, today there is far stronger focus on, and commitment to, helping people thrive at work. The cultural benefits of doing so are clear to see.

A cautionary tale

The cultural issues outlined in the banking royal commission report are not unique to the banking and financial services sector. There will be many organisations across a multitude of industries that have actively fostered sales (rather than service) cultures and are watching the current proceedings with great interest and planning how they can start focusing on the right behaviours as opposed to the right outcomes, to avoid similar levels of withering public and regulatory backlash and scrutiny.

Conversely, there will be organisations in that boat who think they have nothing to worry about and risk being shredded if they don’t at least consider strategic and culture change.

Some financial institutions have been making moves in the right cultural direction for some time; others are starting from a long way back. Whatever the case, when it comes to wholesale culture reform, they could do a lot worse than start with the role employee recognition, done well, can play.

O.C. TANNER | ACCUMULATE O.C. Tanner, the global leader in engaging workplace cultures, helps thousands of top companies create peak moments that inspire people to achieve, appreciate, and thrive at work. Learn how to infl uence greatness in your organisation with O.C. Tanner’s Culture Cloud™ at octanner.com.