This SurePayroll review delves into the payroll software's features, integrations, plans and pricing, and potential drawbacks

Are you an HR professional who is tired of struggling with the complexities of payroll management? If so, you might want to consider payroll software as a solution to your problems. With the right payroll software, HR teams can guarantee that their employees are paid correctly and on time, eliminating the stress of missed payments and inaccurate paychecks.

By reducing the occurrence of payroll errors, payroll software saves valuable time for HR teams and improves overall employee satisfaction. SurePayroll is one example of payroll software. SurePayroll is an online payroll platform designed specifically for small businesses and offers access to features such as online pay stubs, direct deposits, and unlimited pay runs. In this payroll software review, we will delve into SurePayroll’s features, integrations, plans and pricing, and potential drawbacks.

SurePayroll manages all your company’s payroll processing requirements and tax obligations. SurePayroll offers a user-friendly platform that can be run from any location with stable internet access, allowing employees and HR managers to view their payroll details, such as pay stubs and tax forms, at their convenience.

Advantages of SurePayroll

SurePayroll offers a range of valuable features to meet a business's payroll and tax requirements. In this section, we will get into each of them in more detail.

SurePayroll provides businesses with accurate and reliable tax calculation and filing services, allowing HR departments to focus on their core operations.

SurePayroll offers an accurate tax liability calculation guarantee, ensuring that businesses remain compliant with changing tax laws. Additionally, SurePayroll includes a tax payment and filing guarantee, providing businesses with peace of mind and protection in the event of an error or issue.

SurePayroll allows HR teams to gain employee insights from payroll, employee, benefits, and status reports.

Users can view and download customizable reports, providing them with relevant data and metrics to help them make informed decisions. The feature also includes an integrated timeclock, which eliminates manual errors and ensures accurate time tracking.

SurePayroll provides businesses with the convenience of direct deposits, ensuring accurate and timely payments to employees. With this feature, HR managers can trust that their employees are paid correctly and on time.

SurePayroll also offers same-day and next-day payroll options, further improving the speed and efficiency of their payroll processes. Additionally, businesses can take advantage of the Cancel Payroll feature - within its cancellation window - to fix errors and make corrections.

SurePayroll allows HR teams to save time by automating their regular payroll runs. With this feature, users can receive reminders before the processing date, ensuring that they stay on top of their payroll schedule. HR managers can toggle the feature on and off at any time, giving them control over when and how they use the feature.

With SurePayroll’s app, users can access their payroll account from their mobile device, tablet, or desktop computer. The app enables businesses to grant their employees instant access, allowing them to view their pay stubs, time-off requests, and other important payroll information.

SurePayroll provides small businesses with various options to comply with mandated benefits and coverage regulations, including affordable and transparent 401(k) plans designed for small businesses, as well as workers’ compensation insurance with flexible pay-as-you-go payment options.

Here is an overview of the features that SurePayroll provides:

Yes! SurePayroll provides accounting software integrations to make payroll and tax management easier for small businesses. These integrations include Time Clock Integration, Intuit Quickbooks, Xero, and Less Accounting. Do you want one more integration? OK! Here you go:

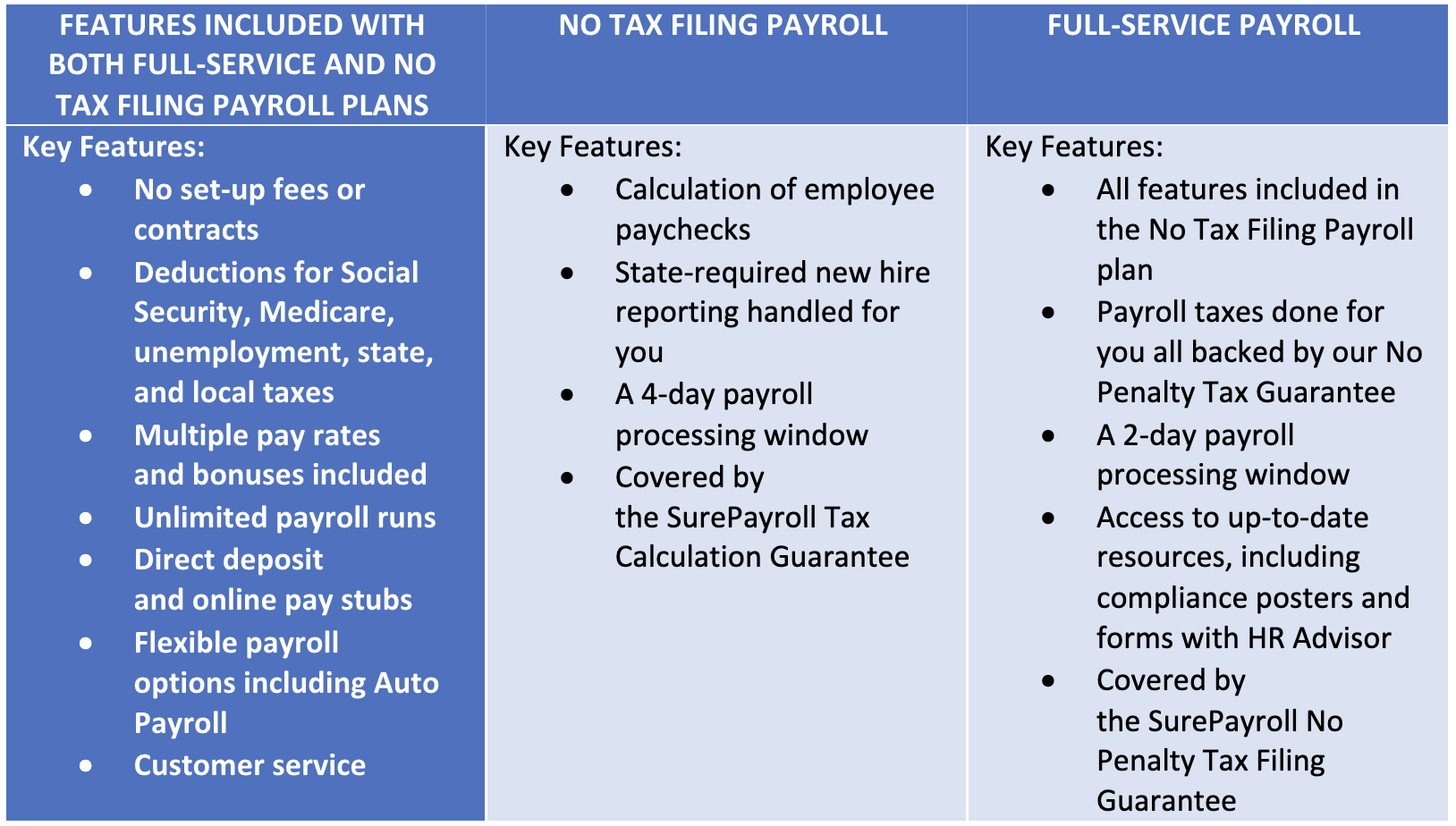

SurePayroll offers two plans for its customers: Full-Service Payroll and No Tax Filing Payroll.

Here is an overview of the software plans that SurePayroll offers:

SurePayroll’s Full-Service plan costs $29.99 per month, plus an additional $5 per employee per month. However, there may be other charges, such as the cost of creating and distributing W-2s and 1099s, which can add up quickly. Additionally, there is a charge for SurePayroll’s time clock integration.

On the other hand, the No Tax Filing plan costs $19.99 per month, plus $4 per employee per month. Unlike the Full-Service plan, the employer is responsible for submitting their own payroll taxes and filings as the No Tax Filing plan only calculates them. Additionally, if an employer wants the same two-day payroll processing offered by the Full-Service plan, they must pay an extra $7.99 per month.

SurePayroll takes the security and privacy of their clients' information very seriously.

Here are some of the ways that SurePayroll ensures security:

Headquarters address: 2350 Ravine Way, Glenview, Illinois, 60025, United States

Year established: 2000

Number of employees: 300+

Locations: Offices in Illinois, Florida, and New Mexico

Businesses served: 200+

Key people: Jason Copeland (Head of Service Delivery), Linda Alperin (Head of Sales), Jenna Shklyar (Head of Marketing), Amber Aggarwal (Head of IT), Jamal Ayyad (Head of Product Management), Sara Webeck (Sr. Manager, Enterprise PMO), Maria Feller (Manager, Finance)

SurePayroll disrupted the payroll industry by launching the first fully online payroll and payroll tax-filing solution for small businesses. Since its founding in 2000, SurePayroll has remained committed to its mission of supporting small business owners in the United States by providing innovative payroll and related services, coupled with best-in-class customer support. In 2011, SurePayroll became a subsidiary of Paychex, Inc., enabling it to provide customers with even more resources and support.

SurePayroll is a highly capable online payroll solution. However, there are still some drawbacks to consider.

SurePayroll charges an additional fee for year-end tax services, and it does not offer the option to sign and mail paper checks for employers, which means employers have to print checks themselves if they require paper checks for employees. Additionally, same-day and next-day payroll runs come at an extra cost with the self-service option, as well as integrating time tracking software.

While SurePayroll is a great option for businesses operating within the United States, it may not be the best choice for companies with an international presence, as the software has limited customization options and a limited number of integrations available.

If you would like to check how SurePayroll measures up with other payroll software, we have put together a list of alternative payroll software options worth exploring:

SurePayroll is an excellent choice for HR managers looking for a capable and user-friendly payroll software for their small business. With its ability to handle all payroll processing needs and tax requirements, SurePayroll offers convenience and peace of mind. Moreover, SurePayroll offers additional small business services, such as support for health insurance and retirement plans, making it a one-stop-shop for small business HR needs.

Choosing the right HR software for your business can be a game-changer, and it is not a decision that should be taken lightly. That is why we've done the research and picked out the best HR software options to make your decision-making process a little easier.