Report looks at the biggest reasons why Canadian workers are focused on saving, by age group

While many Canadians may be struggling with the cost of living these days, many still aspire to move into their own home one day, according to a recent report.

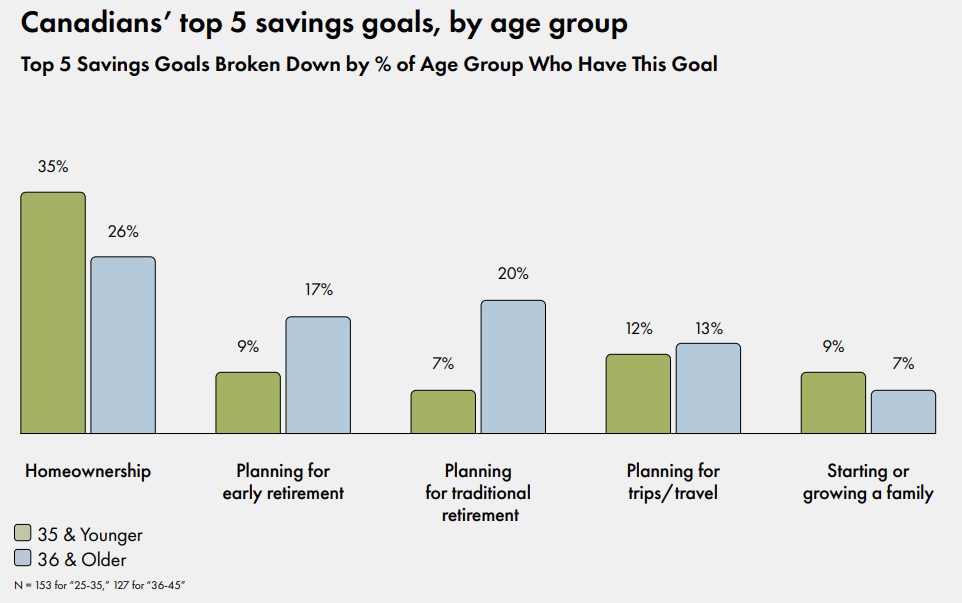

Homeownership is the top savings goal for Canadians, according to a report from investment management firm Wealthsimple.

This is true for workers aged 35 or younger (35%) and 36 or older (26%).

Previously, Dallas Area Habitat for Humanity, launched its "Welcome Home Program," which assists the company's employees in purchasing a home by providing them with down payment and closing cost assistance.

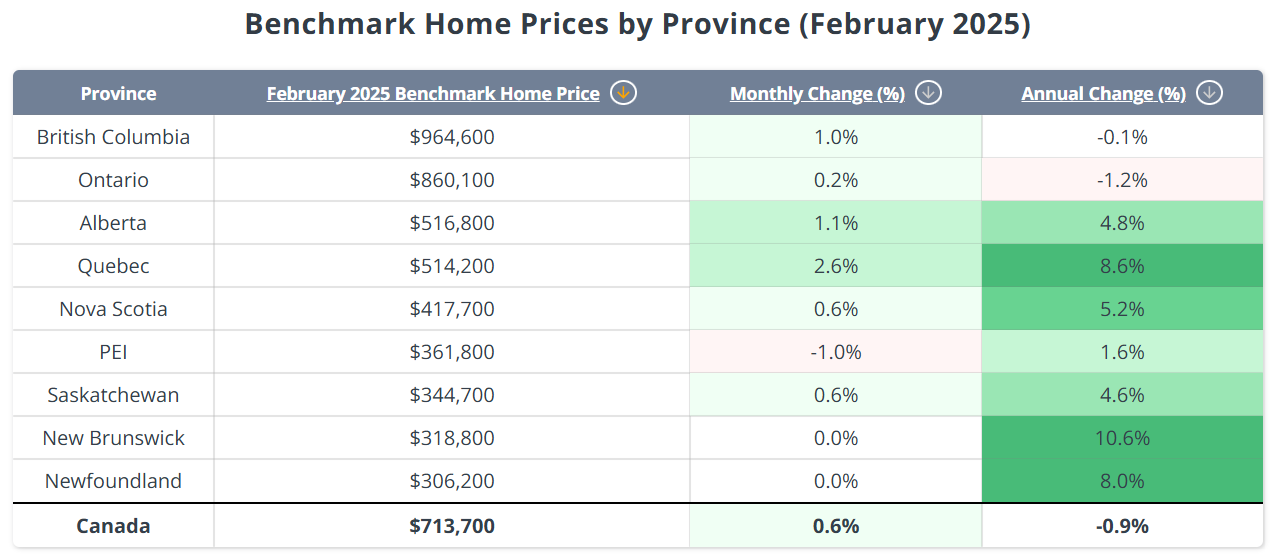

As of February 2025, here’s how much it would take for Canadians to be able to afford their own home, according to finance encyclopedia WOWA:

The high cost of living and having low income are the top two barriers to Canadians’ desire for homeownership, according to Nerdwallet.

While homeownership is the top goal for Canadians, respondents vary in their other financial aspirations by age groups, according to Wealthsimple’s survey of 500 employees.

Workers aged 35 or younger prioritize the financial freedom to do some travelling and to start their own family. Meanwhile, older Canadians are favouring retirement readiness.

With these varied goals in mind, 93% of Canadian workers say it’s at least moderately important that their employer offers retirement savings or other financial benefits. Of these:

Moreover, 91% report that if their employer provided what they considered a great financial wellness program, it would:

Over a quarter (27%) of respondents say the stress of household finances impacts their productivity at work.

Here’s what workers want to be included in their employers’ financial wellness programs:

(Insert photo: Features)

Three in five Canadian professionals think commuting expenses are the most crucial cost to have subsidized by employers, according to a previous report from Robert Walters Canada.

To build a successful, effective financial wellness program that meets the needs of your employees, you’ll need a good understanding of their financial challenges, needs and preferences, according to the Financial Consumer Agency of Canada.

“The best way to develop this is to ask them,” it says.

After assessing employees’ needs, employers must take a close look at the results. This can help you determine the following, according to the government:

“The findings from your employee needs assessment will also help you determine what content and delivery methods will work best,” according to the federal government.

Financial stress is still the top worry for workers aged 40 to 60, according to Healthcare of Ontario Pension Plan (HOOPP).