'Canadians must now plan for how they'll live and fund two or even three decades of retirement'

Life in retirement does not look good for many Canadians who still are looking at post-work life ahead, according to a recent report from Manulife.

Overall, 51% of Canadians believe their retirement savings are falling behind. For each age group, just about 4 in 10 say retirement savings are on track: 42% among baby boomers, 35% among Gen X workers and 36% among Gen Z and Millennial workers.

This comes as life expectancy has become far longer than it was decades ago: It stands at 83 years, up from 68 years in 1950. Meanwhile, nearly half (47%) of retirees left the workforce sooner than expected, shortening their savings period and extending their retirement years.

“All over the world, people are living longer. While we used to count retirement in years, now, many of us can look forward to counting it in decades,” says Aimee DeCamillo, global head of Retirement, Manulife Investment Management. “With life expectancy over 80, Canadians must now plan for how they’ll live and fund two or even three decades of retirement. This year’s report brings additional clarity to help members save, stay invested, and transition into retirement.”

Amid the rising cost of living, Canadians are struggling to save up for retirement, according to a previous report. Overall, one-third of Canadians say they are having trouble planning for retirement. And the cost of living is negatively impacting their retirement savings, say 75% of Canadians in the Sun Life survey.

Currently, 61% of baby boomers and about half of Gen X (50%) and Gen Z and Millennial (51%) workers say saving for retirement is a priority, based on Manulife’s survey of 1,572 Canadians, aged 18 and up, employed, and contributing to an employer-sponsored retirement plan., conducted May 9 to 29, 2024.

However, 42% of Baby Boomers, 50% of Gan X workers and 35% of Gen Z and Millennial workers expect to retire later to pay off debt.

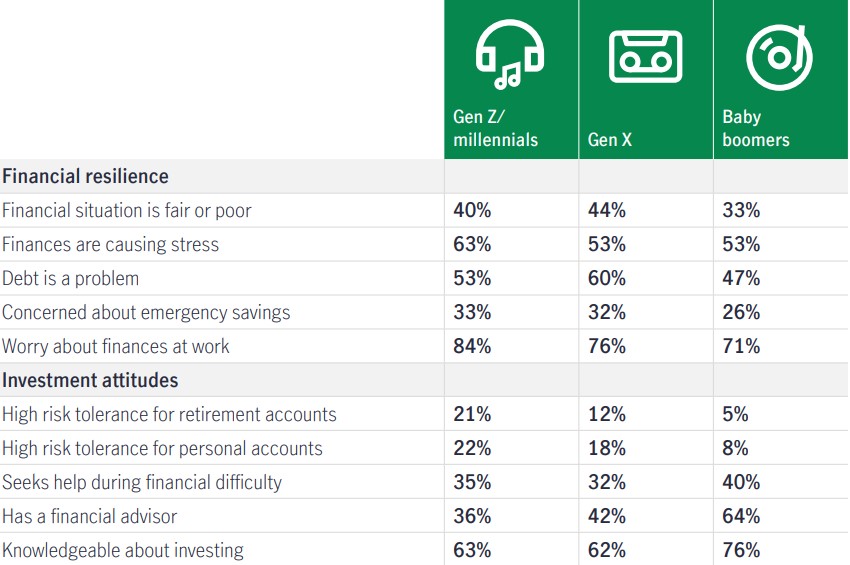

While most Canadians have a formal retirement plan – 72% among Baby Boomers, 70% among Gen X workers and 65% among Gen Z and Millennial workers – 60% of Gen X workers and nearly half among Gen Z and Millennial workers (53%) and Baby Boomers (47%) say debt is a problem.

Many workers say their financial situation is fair or poor, and the majority say finances are causing them stress.

Source: Manulife

“There is significant opportunity for every age to help improve their finances before they retire,” says Manulife.