Those with formal retirement plans have far better retirement outlook than those who don’t, finds report

The high cost of living is having an impact on when Canadians plan to retire, and more are leaning towards extending their working life, according to a Fidelity Investment Canada report.

Over two in five (43%) are now planning to retire later than they originally expected or planned, up from 37% in 2023.

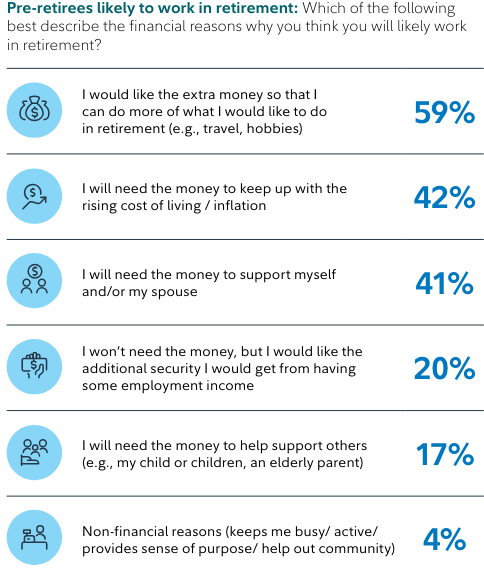

Among those delaying retirement, very few are doing so for non-financial reasons:

Source: Fidelity Investment Canada

For pre-retirees, once they reach retirement age, many are hoping that they:

More than half (55%) of workers in the education sector are looking to continue working even past their retirement age, according to a previous report.

Even after they retire, Canadians are not done having to spend money on their children, according to Fidelity’s survey of 2,000 Canadians with a median age of 62, conducted Jan. 9 to 23, 2024. In fact, 59% of them report that they are helping their children in some form financially during their retirement.

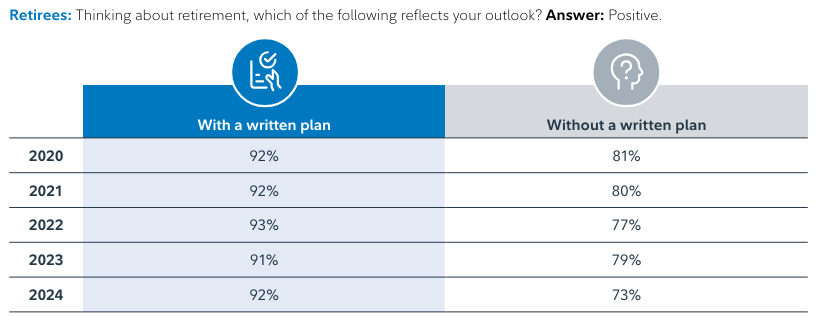

With all these factors in play, a formal retirement plan is proving to be more valuable to Canadian employees, according to Fidelity’s report.

Source: Fidelity Investment Canada

"Achieving your retirement dreams is possible with a strong plan in place," says Peter Bowen, vice president for tax and retirement research, Fidelity.

“Despite uncertain economic times, working with a financial advisor, developing a written financial plan, sticking to that plan, and especially staying invested can help Canadians live the retirement they envision. In this year's report, we found that planning for additional expenses for loved ones and incorporating that into a financial plan stood out as adding value."

Source: Fidelity Investment Canada

While 72% of Canadians aged 35 and up have started saving for retirement, 42% are saving for retirement without a retirement plan, according to a previous report from IG Wealth Management.