CFIB survey shows many employers 'hanging on to existing employees'

Canada's small businesses are showing increasing signs of concern as the labour market continues to cool, according to the latest Canadian Federation of Independent Business (CFIB) Monthly Business Barometer.

In September, only 12 per cent of small and medium-sized enterprises (SMEs) indicated plans to hire in the near future, reflecting a notable slowdown. These businesses make up over 99 per cent of Canada's private sector employers and 38 per cent of its workforce.

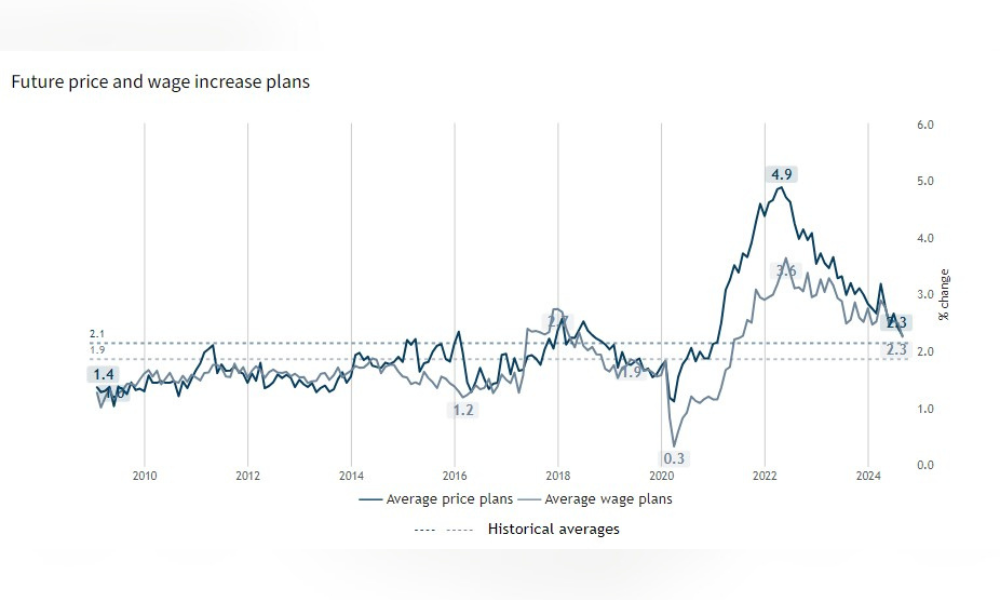

The survey, which gathered responses from 630 CFIB members between September 3 and 16, reveals that shortages in skilled labour (40 per cent) and un/semi-skilled labour (16 per cent) have reached their lowest levels in more than two years. Additionally, the planned increases in wages and prices have dropped to an average of 2.3 per cent, also the lowest point seen in over two years.

“Labour market indicators clearly show employers are on the brakes,” said Simon Gaudreault, CFIB's Chief Economist and Vice-President of Research. “At the same time, price and wage plans are on par and overall are trending downwards, which is good news.”

Source: CFIB Monthly Business Barometer www.cfib-fcei.ca

The demand for products and services remains a significant issue, with over half (53 per cent) of small businesses reporting that insufficient demand is constraining their growth. This is nine percentage points higher than the long-term average, signaling a substantial challenge for business owners.

Other cost pressures, such as insurance (68 per cent), taxes (67 per cent), and wages (67 per cent), continue to weigh heavily on small businesses. These costs have been consistently above historical averages for over a year.

“As businesses are dealing with reduced demand, lower revenues, and higher costs, they’re less likely to hire. Instead, they’re hanging on to their existing employees,” said Andreea Bourgeois, Director of Economics at CFIB.

“A lot of SME employers are currently looking for clearer signs of economic improvement before they can make growth-fueling decisions again.”

The long-term confidence index for small businesses dropped by two points in September, settling at 55.0. This marks the 27th consecutive month the index has remained below the historical average of 60, further illustrating the persistent challenges facing entrepreneurs.

“The small business optimism index has slightly dropped this month, a disappointing result that is further extending the stretch of subpar confidence displayed by Canadian entrepreneurs,” Gaudreault added.

“There’s ample room for improvement in the coming months, with a monetary policy that is likely to remain overly restrictive for a while, no matter how fast the Bank of Canada cuts interest rates.”

CFIB data suggests that reducing interest rates further—or accelerating cuts—would help alleviate the financial strain on small businesses struggling with high costs.