'Hours worked fared a bit better than jobs, snapping a two-month losing streak,' says economist

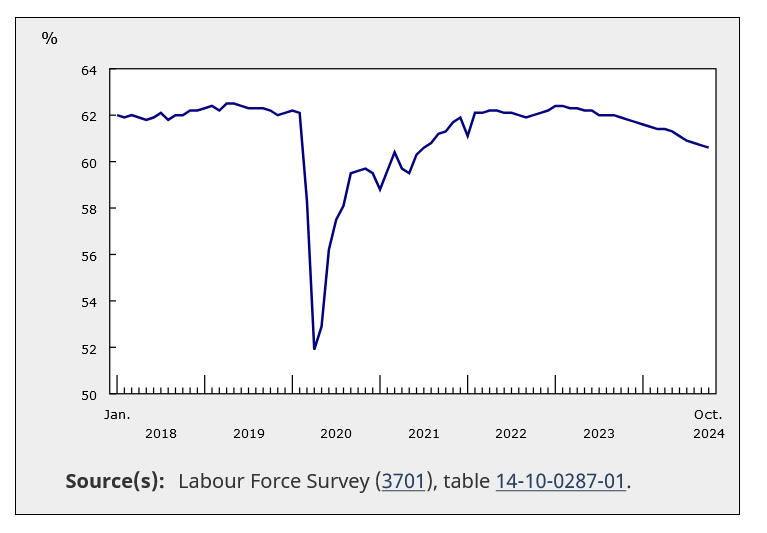

In October, Canada’s labour market grew by just 15,000 jobs (+0.1%), a minor gain that was largely offset by population growth, leading to a 0.1 percentage point decline in the employment rate to 60.6%.

The unemployment rate held steady at 6.5%, echoing the minimal gains from September and reflecting a labour market facing mounting pressures as population growth continues to outpace job creation, says Statistics Canada in its Labour Force Survey.

The labour force participation rate fell by 0.1 percentage points to 64.8%, marking its fourth monthly decline since May.

This decline was largely driven by population aging and slowed labour market demand, pushing participation to its lowest point since 1997 (excluding pandemic years).

Brendon Bernard, senior economist at Indeed, described October’s report as “more of the same” for the Canadian job market, emphasizing that job creation continues to lag behind Canada’s rapid population growth.

Youth employment (ages 15-24) saw a 33,000 (+1.2%) increase in October, led by gains among male youth (+25,000; +1.8%), says Statistics Canada. While this group’s employment rate rose slightly, it remains down by 2.7 percentage points from October last year.

Female workers aged 55 and older, however, saw a significant drop of 15,000 jobs (-0.8%), highlighting challenges in the job market for older employees.

“Middle-aged and older workers are starting to see deterioration in conditions,” says Bernard.

“While youth employment rates are down sharply from a year ago, they’ve edged up since the summer. Meanwhile, the share of those aged 25-54, as well as those 55 and older with a job has ticked down over three straight months.”

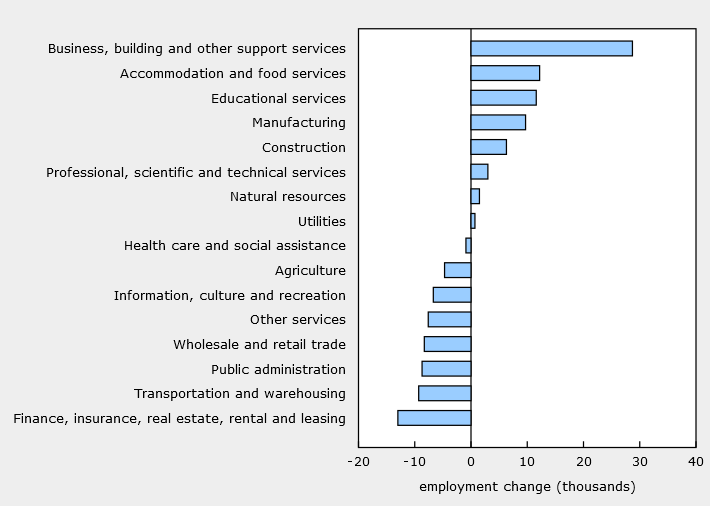

Employment saw mixed changes across industries. The business, building, and support services sector gained 29,000 jobs (+4.2%), showing the first increase in this area since May, says the Labour Force Survey.

Conversely, finance, insurance, real estate, and leasing lost 13,000 jobs (-0.9%), while public administration declined by 8,700 positions (-0.7%).

Regionally, Alberta and New Brunswick recorded employment increases of 13,000 (+0.5%) and 3,300 (+0.8%), respectively. However, Prince Edward Island’s employment declined by 1,100 jobs (-1.2%), pushing its unemployment rate to 10.0%, a sharp increase of 2.9 percentage points.

In a positive development, total hours worked rose by 0.3%, snapping a two-month streak of decline, according to Statistics Canada.

“Hours worked fared a bit better than jobs, snapping a two-month losing streak,” Bernard says, signaling some resilience in labour demand.

October’s wage growth also outperformed other indicators, with average hourly earnings up by 4.9% year-over-year, reaching $35.76.

“It’s been a surprise all year to see wage growth continuously defy the otherwise negative trends,” he says, citing wage gains hovering around 5% as inflation has cooled.

These gains reflect a “catch-up” from last year’s inflation surge, he says: “The ingredients for future growth have faded, and still wage growth approaches the end of 2024 in quite robust shape.”