It’s complicated and riddled with potential minefields, but payroll for MNCs doesn’t have to be a risky prospect, writes ADP’s Sean Murphy

LEGISLATIVE COMPLIANCE: in a business context it is more visible in the breach than the observance, to paraphrase the Bard. And since companies, and particularly multinationals, must conform to an ever-increasing number of statutory dictates, we should not be surprised that some occasionally fall foul of the law – did someone say Single Touch Payroll or vulnerable workers bill?

The term ‘global village’ was coined by Canadian media theorist Marshall McLuhan in the mid-1960s. A recurring theme in his books, it describes a world that has been ‘shrunk’ by modern advances in communications. McLuhan compared the vast network of communications systems to one extended central nervous system, ultimately linking everyone in the world.

Today, multinational corporations exhibit some of the collective identity traits presaged by McLuhan in his seminal works. Specifically, fragmentation (of data, processes and effort) and its inevitable bedfellow, duplication, are commonly disavowed in favour of consolidation and scalability. It’s an interesting exercise to apply this lens of collective identity to one of the great back-of-house business processes in today’s global village, payroll.

When I say multinational, it’s important to acknowledge that this is not limited to your ASX top 100. A multinational could be a local digital marketing agency of 50 employees that also employs people overseas to do programming. Granted, these businesses have some complexity differences, but as more and more Australian businesses look overseas to new markets or for operational efficiencies, the notion of what is defined as multinational continues to expand.

Compliance and complexity

Payroll challenges for MNCs are many and diverse. Hovering near the top of the list are the organisational metrics of compliance (are we meeting/failing a statutory requirement at country level?) and risk (including, among others, the likelihood of failing to meet a statutory requirement at country level). These are followed in quick succession by the operational metrics of payroll accuracy and timeliness of delivery.

Now, multiply these challenges by n, being the total number of countries in which your employees are operating. This leads to: n x (compliance + risk + accuracy + timeliness) = bh where bh = big headache.

Clunky, but you get my drift. Multicountry payroll is an ever-shifting landscape through which MNCs must navigate. But it’s a tightrope with no safety net. Every payday you have thousands of internal auditors (also called employees) running a ruler over your calculations – and they had better be correct.

Adding to this burden is the complexity of internal payroll business processes, usually stemming from a company’s history of expansion by acquisition. The reasons for M&A activity are many and varied, but non-core processes like payroll are not immediately, and sometimes never, replaced or streamlined as part of such activity. On average, MNCs have a total of 30 payroll systems in place (ADP Research Institute, 2015). It seems that ‘if it ain’t broke, don’t fix it’ – at least not in the short term.

Pain relief

So where does this leave MNCs? Well, with a risk profile trending northward and the forementioned headache, that’s where. But fear not, pain relief can be provided. Let’s talk about Multi-Country Payroll Outsourcing (MCPO).

MCPO

Here is where you outsource, either fully or partially, elements of your payroll burden to industry specialists. In its simplest form it can mean taking advantage of a vendor’s hosted and maintained infrastructure, on which you will perform your own payroll processing using internal resources; so, platform-as-a-service if you will. Your provider will commit to supplying a compliant, regularly updated platform with KPIs around system availability.

Ramp up the service level and you arrive at what is usually called a ‘managed service’. The provider includes resources to process the payroll on your behalf, and works to additional KPIs for accuracy of their calculations and timeliness of delivery of payroll outputs, eg payslips, reports, and general ledger interface files. Customers get the benefit of scale delivered by vendors who deploy thousands of customers onto multi-tenant payroll platforms, and who make use of labour arbitrage to deliver quality services from offshore locations. Some trade-offs ensue, however; clients will usually be required to standardise to some degree their current, possibly unwieldy, practices to reflect those required by their payroll vendor. That’s not a bad thing.

The management of employee queries may be included under managed services, and most providers include it here or as part of a more extensive ‘comprehensive service’ model. Case Management functionality, issue management processes and client/employee support are usually proffered across service models.

An MCPO solution meets many of the MNC challenges head-on, but organisations should appreciate a couple of challenges faced by providers of such services:

So how do MCPO vendors meet these challenges?

Models vary, but typically the MCPO vendor will take in data from the customer, distribute this to its in-country partners (internal and external) for calculation, and manage the full end-to-end processing and reporting cycle.

Now the MCPO vendors’ value coefficient starts to track upwards, because they are the ones responsible for the sourcing, vetting, onboarding, contracting, management, and review of payroll partners in, typically, scores of countries. In contrast, as a company with an on-premise model you may very well have just inherited that payroll guy in ‘country X’ as part of your last merger…

From a software platform perspective you can say an MCPO client gets a ‘hybrid’ model, but that misses the point. Vendors that provide a unifi ed service layer, over the top of a potentially polyglot technical layer, will deliver best value. With payroll outsourcing it is outcomes that matter, not so much the journey (so it’s the message, not the media, with apologies to McLuhan).

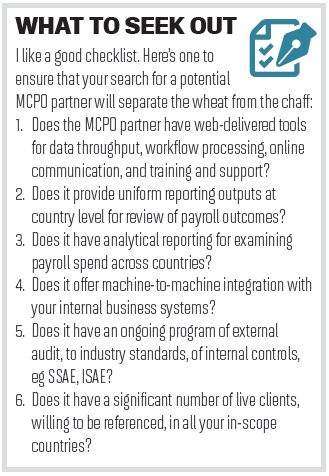

If you can put a tick against each of the above you are well on the way to linking all the actors in your own global payroll village.